Argentina forces money controls as its financial emergency develops

A lady strolls with an Argentinian banner during a walk on the side of President Mauricio Macri on August 24, 2019 in Buenos Aires, Argentina.

Ricardo Ceppi | Getty Images News | Getty Images

Argentina's legislature has forced money controls in an offer to balance out monetary markets, as Latin America's third-biggest economy faces an extending financial emergency.

The impermanent measures, reported on Sunday, enable the legislature to limit remote cash buys following a sharp drop in the super-touchy peso.

All organizations should now demand authorization from Argentina's national bank to sell pesos and purchase outside money to make moves abroad.

In an official release issued on Sunday, the legislature said cash controls were essential "to guarantee the ordinary working of the economy."

The most recent move pursues the unexpected declaration on Wednesday that Argentina would look to concede installments on generally $100 billion of obligation, which FICO assessment organization S&P named a default under its own criteria.

The measures — which will stay set up until the part of the bargain — establish a surprising turnabout for President Mauricio Macri.

Not long after beginning his term in December 2015, the beset pioneer of South America's second-biggest nation unexpectedly evacuated exacting capital controls that had been set up since 2011.

Macri's legislature and the national bank are attempting to support trust in budgetary markets in front of the presidential race on October 27.

IMF wouldn't like to be the one that 'pulled the fitting'

Subsidence hit Argentina has been battling with a money related emergency, which was exacerbated by the president's staggering destruction in an ongoing essential survey.

In a vote seen by numerous individuals as a key measure for the first round of Argentina's presidential decision toward the part of the arrangement, well disposed Macri lost by a far more prominent edge than anticipated to the resistance ticket of focus left Alberto Fernandez and populist ex-pioneer Cristina Fernandez de Kirchner.

The peso tumbled to a record low a month ago, after the essential outcome cast genuine uncertainty over the middle right occupant's re-appointment possibilities.

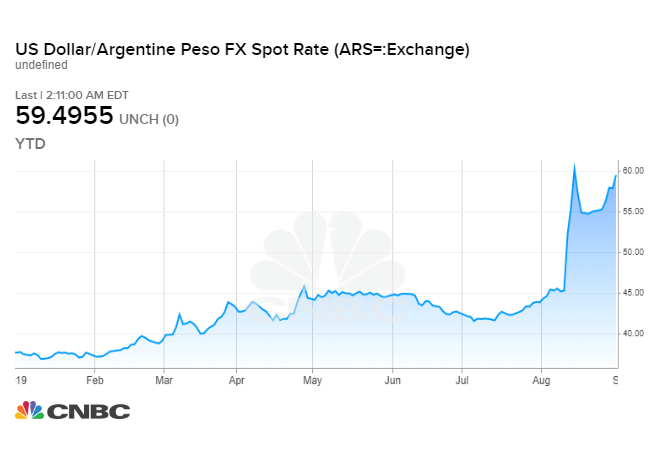

Argentina's cash, seen by some as a guide for the nation's economy, shut at around 59.49 per U.S. dollar on Friday. The peso has fallen over 30% since the August 11 essential vote.

Ricardo Ceppi | Getty Images News | Getty Images

Argentina's legislature has forced money controls in an offer to balance out monetary markets, as Latin America's third-biggest economy faces an extending financial emergency.

The impermanent measures, reported on Sunday, enable the legislature to limit remote cash buys following a sharp drop in the super-touchy peso.

All organizations should now demand authorization from Argentina's national bank to sell pesos and purchase outside money to make moves abroad.

In an official release issued on Sunday, the legislature said cash controls were essential "to guarantee the ordinary working of the economy."

The most recent move pursues the unexpected declaration on Wednesday that Argentina would look to concede installments on generally $100 billion of obligation, which FICO assessment organization S&P named a default under its own criteria.

The measures — which will stay set up until the part of the bargain — establish a surprising turnabout for President Mauricio Macri.

Not long after beginning his term in December 2015, the beset pioneer of South America's second-biggest nation unexpectedly evacuated exacting capital controls that had been set up since 2011.

Macri's legislature and the national bank are attempting to support trust in budgetary markets in front of the presidential race on October 27.

IMF wouldn't like to be the one that 'pulled the fitting'

Subsidence hit Argentina has been battling with a money related emergency, which was exacerbated by the president's staggering destruction in an ongoing essential survey.

In a vote seen by numerous individuals as a key measure for the first round of Argentina's presidential decision toward the part of the arrangement, well disposed Macri lost by a far more prominent edge than anticipated to the resistance ticket of focus left Alberto Fernandez and populist ex-pioneer Cristina Fernandez de Kirchner.

The peso tumbled to a record low a month ago, after the essential outcome cast genuine uncertainty over the middle right occupant's re-appointment possibilities.

Argentina's cash, seen by some as a guide for the nation's economy, shut at around 59.49 per U.S. dollar on Friday. The peso has fallen over 30% since the August 11 essential vote.

Market members had anticipated some type of capital controls from Argentina's legislature. Be that as it may, some are concerned the move could imperil the International Monetary Fund's (IMF) most recent dispensing of its notable $57 billion bailout program.

James Athey, senior speculation chief at Aberdeen Standard Investments, told CNBC's "Screech Box Europe" that despite everything he accepts the IMF will convey another $5.4 billion tranche to Argentina in the not so distant future.

"Basically, the IMF wouldn't like to be the one that pulled the attachment."

Athey contended FICO assessment offices had a similar issue with regards to Argentina, with a considerable lot of them "hurrying" to minimize the nation to garbage status as of late.

"Sensibly, the hidden soundness of the circumstance, I don't think it has changed that drastically. What has happened is that costs of a portion of the outside resources have changed and given the veneer that things are drastically more regrettable… They were in every case really awful."

"In this way, I don't think the IMF needs to be the one that says: 'No, you can't have that last piece of cash'. Be that as it may, $5 billion at this stage is truly tossing a couple of pennies into the wishing admirably," Athey said.

Post a Comment